Picture this: You are your sibling’s caretaker during the COVID-19 pandemic. You moved them into your Montgomery County home and are paying their medical expenses, all while working a full-time and a part-time job. You are in your 60’s.

Then, as the pandemic shuts down businesses, your employer cuts some of your shifts and you fall behind on your mortgage payments. Your mortgage company eventually puts you in forbearance, and you don’t know what to do or how to navigate this complicated situation. By the time you have your first appointment with a Clarifi counselor, you’re $33,000 past due.

You tell your counselor, “You’ve got to help me.”

This is the story of homeowners across the country, and in particular Montgomery County, where home prices have soared amid already high taxes. In the Montgomery County metropolitan area, first-time homebuyers must earn more than $82,000 to afford a starter home — roughly 20% more than the required income last spring. That’s compared to just under $35,000 needed to afford a starter home in the Philadelphia metropolitan area.

Montgomery County’s “unique economic position in the region” makes it a desirable community, but that also has “a detrimental effect on the supply of attainable housing within the county for low and middle-income homebuyers,” per a 2022 county data report. The median listing price for a MontCo home was just under $475,000 in August 2023, trending up 8% year-over-year.

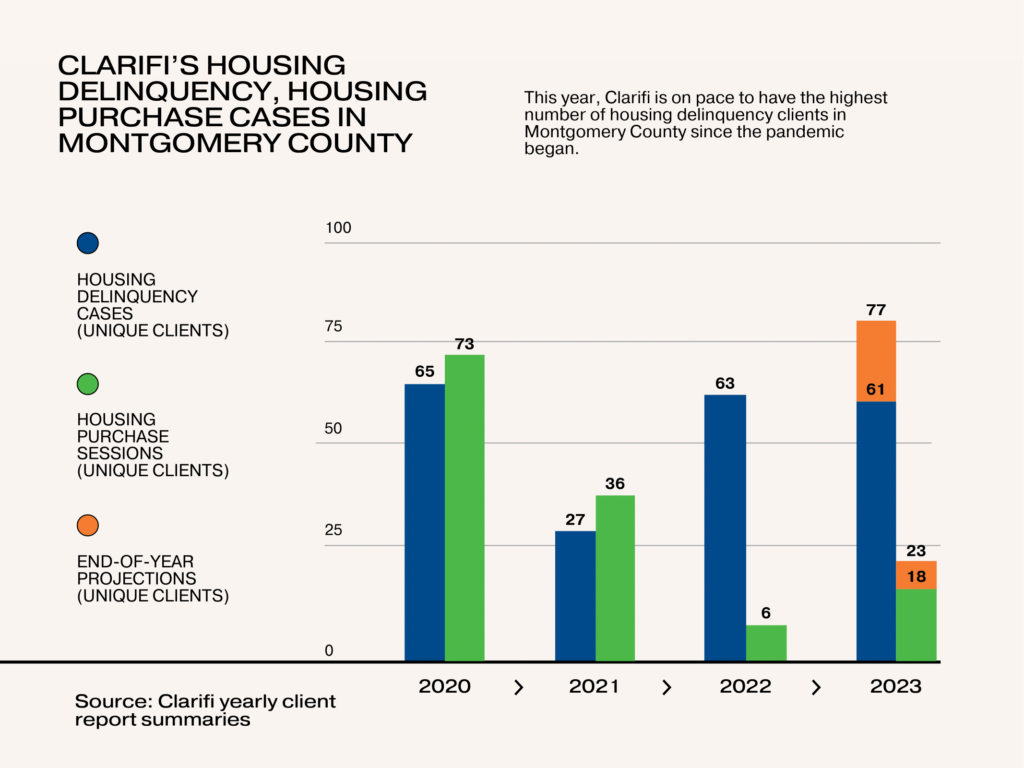

For current homeowners struggling financially, rising interest rates have made it increasingly difficult to apply for reduced payments through a loan modification. This year, Clarifi is on pace to have the highest housing delinquency case numbers in MontCo since the pandemic began.

This is why it is important to expand not only our housing counseling but also our financial empowerment model to more suburban areas such as MontCo. Here, our counselor was able to help the client above apply for homeowner financial assistance. Nine months after applying, they were awarded the necessary funds to save their home and are now current on their mortgage.

The counselor also worked out a detailed budget, going through the client’s bank statement and pointing out where to cut down on expenses. These suggestions are now saving the client hundreds of dollars per month. The homeowner is better prepared for unexpected expenses and life changes – what we call financial resilience.

Part of Clarifi’s mission is to get people on a path to homeownership when they are ready, because that is how most families build wealth. But our services don’t stop at the time of purchase. We work to keep people in their homes, from helping them apply for a low-interest home repair loan to hashing out a budget and emergency savings plan.

Now, this client can stay in the community and house they’ve called home since 2002.